Cloud gaming market research report

Sunday, February 25, 2024

|

Richard Harris |

Cloud gaming platforms are increasingly focusing on optimizing their services for mobile devices, tapping into the rapidly growing mobile gaming market. By offering seamless streaming experiences on smartphones and tablets, providers are catering to the evolving gamers who prefer gaming on the go.

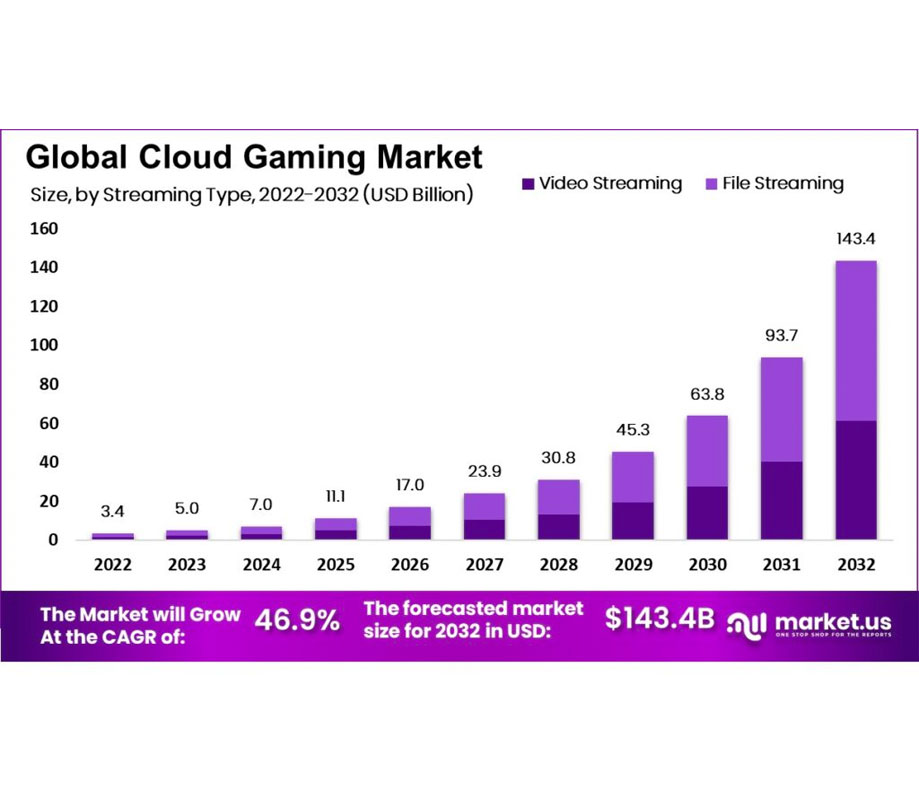

According to Market.us, The cloud gaming market is poised for exponential growth, with its value estimated at USD 5.0 billion in 2023. This sector is expected to undergo a remarkable transformation, reaching a projected revenue of USD 143.4 billion by 2032. Such a surge represents a Compound Annual Growth Rate (CAGR) of 46.9% between 2023 and 2032, indicating the increasing consumer demand and technological advancements in cloud gaming.

Cloud gaming market to soar to USD 143.4B by 2032, driven by technological advancements and growing demand for high-quality gaming experience

This significant growth trajectory underscores the shift towards more accessible, high-quality gaming experiences, facilitated by cloud technology, which allows players to stream games directly to their devices without the need for expensive hardware. The rapid expansion of this market reflects broader trends in digital transformation and consumer entertainment preferences, positioning cloud gaming as a key driver of future innovations in the gaming industry.

Global cloud gaming market size by streaming type 2022-2032

Important revelation:

- The Cloud Gaming Market is projected to reach a substantial value of approximately USD 143.4 billion by 2032, showing a remarkable growth from its 2023 value of USD 5.0 billion, with a compounded annual growth rate (CAGR) of 46.9%.

- User base expanded to 29.8 million, up from 18.7 million in 2023.

- Europe accounts for a 27% revenue share in the cloud gaming market.

- PlayStation Now has 3.6 million subscribers.

- Xbox Cloud Gaming boasts 4.2 million users.

- Nvidia GeForce Now's user base stands at 9 million.

- Mobile/tablet gaming represents a 41% share of the cloud gaming market.

- Average monthly data usage per cloud gaming user is 21 GB.

- Smartphone gaming stands out as the dominant device segment in the Cloud Gaming Market due to its affordability and enhanced performance, particularly with the advent of 5G networks and unlimited data plans, making mobile gaming more accessible.

- File streaming emerges as the predominant streaming type segment in the Cloud Gaming Market, offering game developers cost-saving advantages and contributing to rapid compound annual growth rates.

Factors affecting the growth of the cloud gaming market

- Advancements in Cloud Technology: The evolution and enhancement of cloud infrastructure, including improvements in data center capacities, network bandwidth, and cloud computing capabilities, have significantly contributed to the scalability and performance of cloud gaming services.

- Widespread High-Speed Internet Access: The proliferation of high-speed internet connections, including 5G technology, has made cloud gaming more accessible and enjoyable for a broader audience, reducing latency issues and improving game streaming quality.

- Increasing Adoption of Smartphones and Tablets: The surge in smartphone and tablet usage has expanded the potential market for cloud gaming services, as these devices are increasingly capable of supporting high-quality gaming experiences without the need for expensive hardware.

- Cost-Effectiveness for Consumers: Cloud gaming offers a cost-effective alternative for gamers, eliminating the need for continuous hardware upgrades. This aspect appeals to a wide demographic of gamers, driving market growth.

- Gaming as a Service (GaaS) Model: The shift towards Gaming as a Service model, where players subscribe to access a library of games, aligns well with consumer preferences for subscription-based digital content, fueling the market expansion.

- Network Infrastructure: The availability and quality of network infrastructure, including high-speed internet connectivity and low-latency networks, play a crucial role in the success of cloud gaming. Reliable and robust networks are essential to deliver a seamless gaming experience with minimal lag or latency issues.

Analysis perspective

Based on the latest user statistics for 2024, the cloud gaming market demonstrates a significant global presence with a total of 29.8 million users worldwide. North America emerges as the leading region in cloud gaming adoption, boasting 17.3 million users, followed by Europe with 8 million users. The Asia Pacific region exhibits a growing interest in cloud gaming, with 3.6 million users, while the rest of the world collectively accounts for 0.9 million users.

When examining user preferences, mobile cloud gaming emerges as a prominent trend, with 12.2 million users opting for gaming experiences on handheld devices, representing 41% of the total user base. This underscores the importance of mobile accessibility and convenience in driving user engagement within the cloud gaming ecosystem.

In terms of user demographics, casual cloud gamers constitute a substantial portion of the market, totaling 14.2 million users. These individuals are characterized by their preference for recreational and spontaneous gaming experiences. Conversely, core or enthusiast cloud gamers, numbering 15.6 million, exhibit a deeper level of engagement with gaming content, often demonstrating a higher propensity for in-app purchases and subscriptions.

Report segmentation

Device type analysis:

The device type segment in the cloud gaming market is influenced by factors such as cost, performance, and accessibility. Smartphones, with their widespread adoption and increasing processing power, have emerged as the leading device type in cloud gaming. Smartphones offer the advantage of being portable, allowing users to play games on the go. Additionally, smartphones are relatively affordable compared to gaming consoles or high-end PCs, making them accessible to a larger user base. The continuous advancements in smartphone technology, including improved graphics capabilities and larger screens, have further enhanced the gaming experience on these devices. As a result, smartphones are driving the growth in the device type segment of the cloud gaming market.

Streaming type analysis:

In the streaming type segment of the cloud gaming market, file streaming dominates. File streaming involves the delivery of game files to the user's device, which are then locally processed and rendered. This streaming method offers advantages such as lower latency and reduced dependence on real-time network performance. File streaming allows for a more responsive gaming experience, as the game data is processed locally, resulting in minimal lag or latency issues. It also provides greater control over the gaming environment and enables offline gameplay in some cases. These factors contribute to the dominance of file streaming in the cloud gaming market's streaming type segment.

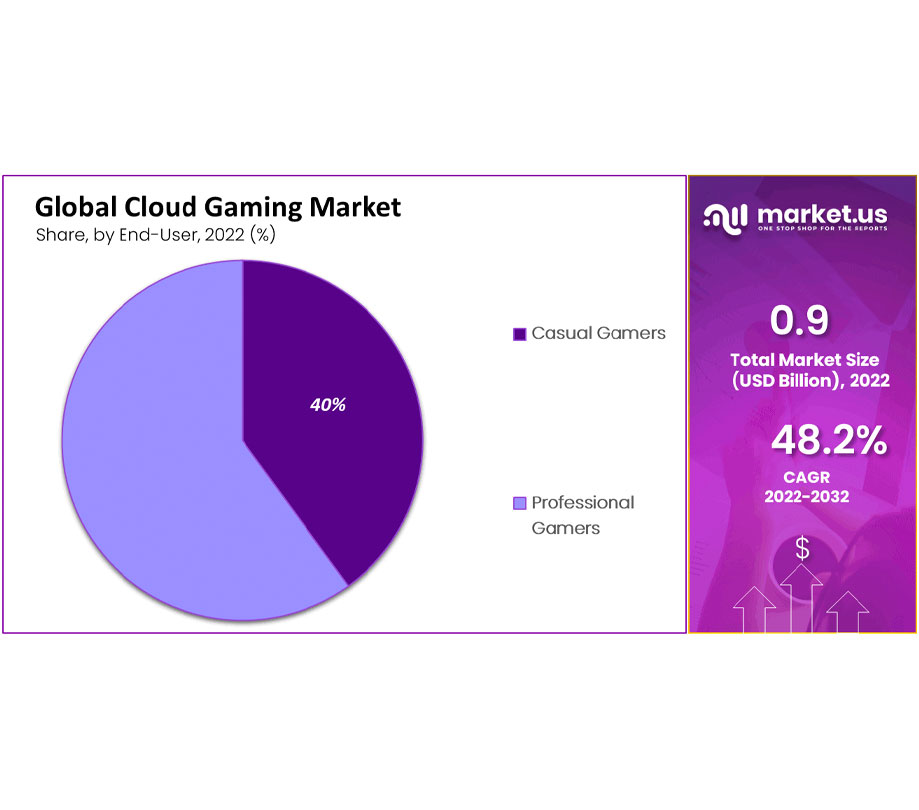

End-user analysis:

Within the end-user segment, casual gamers lead with the highest compound annual growth rate (CAGR). Casual gamers are individuals who play games for entertainment and leisure, without a deep commitment to specific genres or competitive play. This segment includes a broad range of demographics, including occasional gamers, mobile gamers, and individuals who prefer simpler or less time-intensive games. The high CAGR in the casual gamer segment can be attributed to the increasing adoption of cloud gaming among a wider audience, driven by factors such as affordability, accessibility, and the availability of casual game titles. Cloud gaming platforms often offer a diverse library of casual games that cater to the preferences and time constraints of this user segment, further driving its growth.

Global cloud gaming market share by end-user 2022

Impactful driver

An impactful driver for the cloud gaming market is the increasing demand for convenient and accessible gaming experiences. Cloud gaming allows users to stream and play games on various devices without the need for high-end hardware, making it a cost-effective and flexible option. The ability to access a vast library of games anytime, anywhere, coupled with the convenience of not having to install or update games, attracts a wide range of gamers.

Key trend

One key trend in the cloud gaming market is the integration of advanced technologies such as 5G, edge computing, and virtual reality (VR). The rollout of 5G networks enables faster and more stable connections, reducing latency and enhancing the streaming experience. Edge computing brings computing power closer to the user, reducing latency even further. Additionally, the integration of VR technology into cloud gaming provides an immersive and interactive gaming experience, further expanding the possibilities for gamers.

Challenges

However, the cloud gaming market also faces major challenges. One significant challenge is network infrastructure limitations. Cloud gaming heavily relies on high-speed and low-latency networks to deliver a smooth gaming experience. In regions with inadequate network infrastructure or areas with poor internet connectivity, users may face issues such as lag, latency, and reduced video quality, hindering the adoption and growth of cloud gaming.

Another challenge is the potential for data privacy and security concerns. Cloud gaming involves streaming game data over the internet, raising concerns about the protection of personal information and the risk of unauthorized access or data breaches. Addressing these concerns and implementing robust security measures are crucial to build trust among users and ensure the long-term viability of cloud gaming platforms.

Furthermore, the competitive landscape poses a challenge for cloud gaming providers. Major players in the gaming industry, including established console manufacturers and digital distribution platforms, are entering the cloud gaming market. Intense competition and the need to differentiate themselves in terms of content, pricing models, and user experience require cloud gaming providers to continually innovate and provide compelling value propositions to attract and retain users.

Top market leaders

- Amazon Inc.

- Apple Inc.

- Electronic Arts, Inc.

- Google Inc.

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Sony Interactive Entertainment

- Ubitus Inc.

- Tencent Holdings Ltd.

- Other Key Players

Recent developments

1. Google Inc.

- March 2023: Launched Stadia Pro subscription service offering free games and discounts.

- June 2023: Partnered with Ubisoft to bring several popular titles to Stadia, including Assassin's Creed Valhalla and Far Cry 6.

- December 2023: Expanded Stadia availability to 100 new countries, bringing the total to 200.

2. Ubitus Inc.:

- March 2023: Announced a partnership with Samsung to bring Ubitus cloud gaming service to Samsung Smart TVs globally.

- April 2023: Secured $40 million in Series D funding to further expand its cloud gaming platform.

- October 2023: Launched Ubitus Cloud TV service in Japan, offering cloud gaming access to various smart TVs and devices.

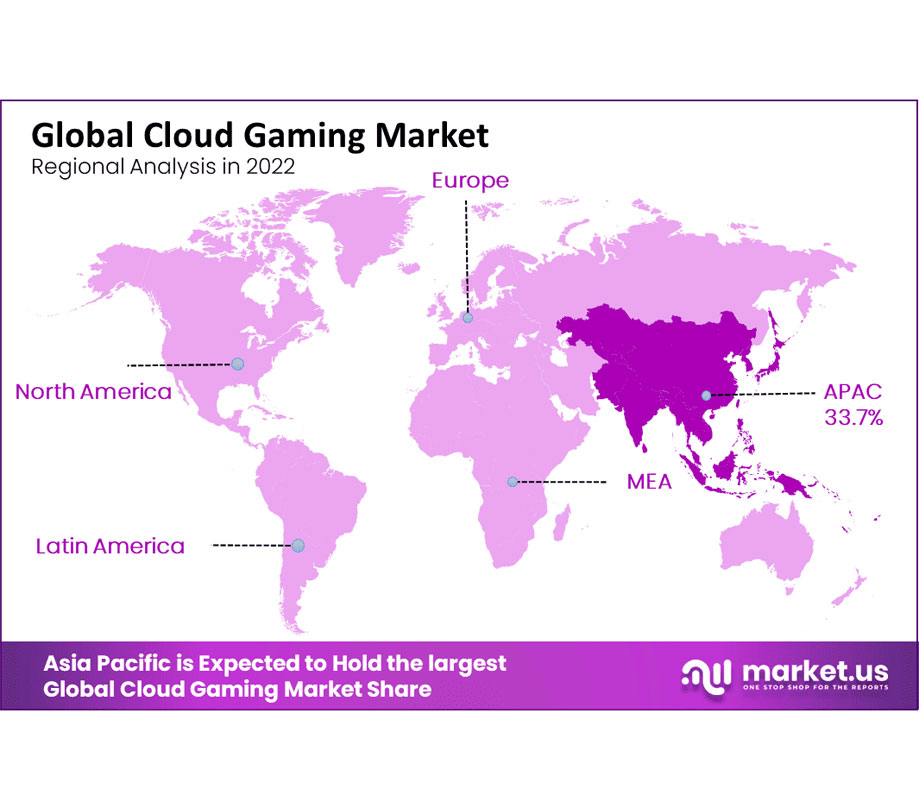

Global cloud gaming market regional analysis in 2022

In the realm of cloud gaming, regional analysis reveals Asia Pacific as a pivotal market, boasting the largest revenue share, accounting for nearly 33.7% of the global market. This dominance is underpinned by several factors unique to the region.

First and foremost, the Asia Pacific region is home to some of the world's most populous countries, including China, India, and Japan. This vast population provides a significant user base for cloud gaming platforms, driving demand and adoption rates.

Moreover, rapid advancements in internet infrastructure across many parts of Asia Pacific have laid the groundwork for the widespread adoption of cloud gaming. Countries like South Korea, Singapore, and Japan have particularly robust internet infrastructures, characterized by high-speed broadband connectivity and extensive coverage, facilitating seamless streaming of games from the cloud.

Furthermore, the thriving gaming culture deeply entrenched in Asian societies contributes to the region's leadership in the cloud gaming market. With a large population of avid gamers, there is a strong appetite for innovative gaming experiences, making cloud gaming an attractive proposition for both consumers and providers.

By geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Market Segments

Device Type

- Smartphones

- Tablets

- Gaming Consoles

- PCs and Laptops

- Smart TVs

- Head-Mounted Displays

Streaming type

- Video Streaming

- File Streaming

End-User

- Casual Gamers

- Professional Gamers

Explore more reports

- Artificial Intelligence Market size is expected to be worth around USD 2,745 billion by 2033, from USD 177 Billion in 2023, growing at a CAGR of 36.8% during the forecast period from 2024 to 2033.

- Drone Market is anticipated to achieve a value of roughly USD 101.1 Billion by 2032, a substantial rise from its 2022 value of USD 30.6 Billion. This progress is expected to unfold at a compound annual growth rate (CAGR) of 12.7% during the projection period from 2023 to 2032.

- Cloud Computing Market size is expected to be worth around USD 2,974.6 Billion by 2033, growing at a CAGR of 16.8%.

- Semiconductor Market is projected to reach a valuation of USD 1,307.7 Bn by 2032 at a CAGR of 8.8%, from USD 625.2 Bn in 2023.

- Cyber Security Market size is expected to be worth around USD 533.9 Billion by 2032 from USD 193 Billion in 2023, growing at a CAGR of 11% during the forecast period from 2022 to 2032.

- Metaverse Market is Expected to Accumulate a Value of USD 2,346.2 Billion by 2032 from USD 65.2 Billion in 2022; Registering a CAGR of 44.4% in the Forecast Period 2023 to 2032.

- Generative AI Market size is projected to surpass USD 13.9 Billion in 2023 and is likely to attain a valuation of USD 151.9 Billion by 2032. The Generative AI industry share is expected to rise at an astounding CAGR of 31.4% from 2023 to 2033.

- 3D Printing Market is projected to be worth USD 19.8 billion in 2023. The market is likely to reach USD 135.4 billion by 2033. The market is further expected to surge at a CAGR of 21.2% during the forecast period 2024 to 2033.

- In 2023, the Smart Homes Market was valued at USD 132.2 Billion and it is expected to reach USD 503.1 billion between 2023 and 2032, this market is estimated to register the highest CAGR of 16.8%.

- Podcasting market accounted for USD 27.3 billion and is expected to reach around USD 133.9 billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 27.8%.

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here