Digital ad spend to soar over the next few years

Monday, June 26, 2023

|

Freeman Lightner |

The insights and projections for the US and global marketing landscape from Linkdaddyseo's recent study are here. They noted that digital ad spend is set to skyrocket by a whopping 47.23% to $835B by 2026 and that search ads were the most invested-in digital advertising in North America in 2022.

Get ready to transform your digital marketing strategy! linkdaddyseo.com has conducted an in-depth study that unveils invaluable insights and projections for the global digital marketing landscape in 2023.

The market size is determined by a survey conducted by linkdaddyseo.com and employing a combined top-down and bottom-up approach. The forecasting process incorporates various techniques tailored to the market's behavior. For instance, the S-curve function is utilized for forecasting digital products due to its ability to capture the non-linear growth pattern associated with technology adoption.

Insights and projections for the USA & global market in 2023

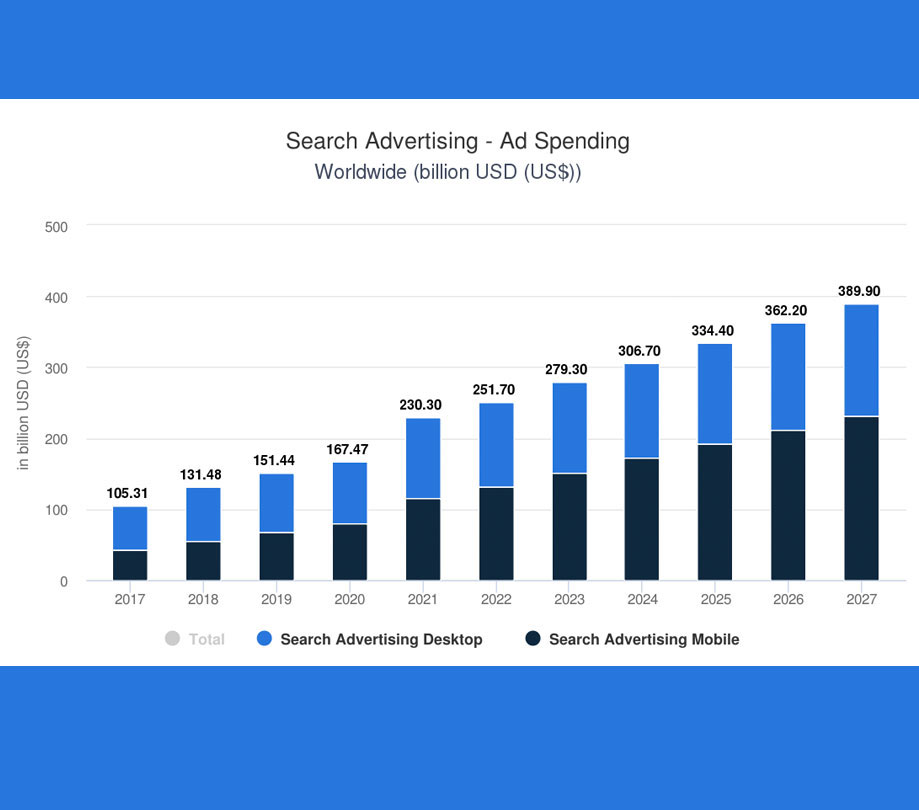

The share of online advertising is expected to grow substantially, potentially reaching 68.5% by 2023 and surpassing 70% by 2025. This prediction is in line with the key findings related to search advertising. In 2023, ad spending in the Search Advertising market is projected to reach US$279.30 billion. It is anticipated to show an impressive annual growth rate (CAGR) of 8.69% from 2023 to 2027, resulting in a projected market volume of US$389.80 billion in 2027. In a global comparison, the United States is expected to generate the majority of ad spending, with a contribution of US$118.20 billion in 2023.

Furthermore, in 2027, it is predicted that US$231.80 billion of the total ad spending in the Search Advertising market will be generated through mobile platforms. The average ad spending per internet user in the Search Advertising market is projected to amount to US$52.39 in 2023. Google remains a dominant player in this sector, holding an estimated market share of 58% in the Search Advertising market for the selected region in 2022. From 2023 to 2027, search advertising is expected to increase by 39.6%.

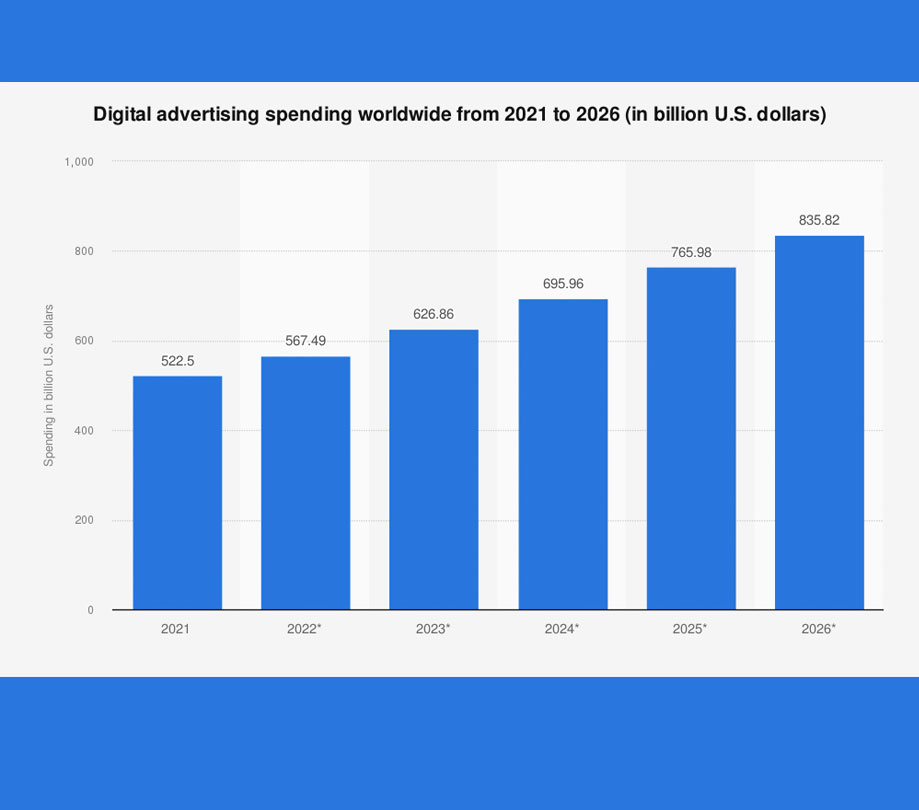

Digital advertising spending worldwide from 2021 to 2026 (in billion U.S. dollars)

Digital advertising spending worldwide amounted to 626.86 billion U.S. dollars in 2023. By 2026, the spending is projected to reach 835.82 billion dollars. The growth rate In the period 2022 to 2026 will be 47.28%. However, the growth will gradually drop to roughly nine percent in 2026.

Global advertising spending has been constantly increasing (except in 2020) since 2010. However, due to technological advances and consumer preferences, not all media are as heavily invested in as others. In 2022, the Internet was considered the most important medium for advertisers, accounting for 62 percent of total media ad spend in 2022. Internet expenditures are projected to record a growth of 8.4 percent till the end of 2023.

Digital advertising spending worldwide including desktop and laptop computers and mobile devices stood at an estimated 522.5 billion U.S. dollars in 2021. 567.49 billion U.S. dollars in 2022, with an increasing rate of 8.61%. This figure is forecast to constantly increase in the coming years, reaching 835.82 billion U.S. dollars by 2026.

Mobile internet advertising is a heavily invested sub-sector of the digital advertising industry. Mobile internet advertising spending is forecast to increase from 276 billion U.S. dollars in 2020 to nearly 495 billion U.S. dollars in 2024. Following this pattern, mobile advertising spending in the U.S. is also forecast to grow in the coming years. Mobile ad spending in the U.S. will reach nearly 25 billion U.S. dollars in 2023.

In 2022, digital advertising accounted for 67 percent of total ad revenue worldwide, according to the forecasts. Moreover, the share of online advertising might grow to 68.5 percent in 2023, surpassing 70 percent in 2025.

China's total digital advertising spending was nearly 142 billion U.S. dollars at the end of 2022, behind the U.S. with approximately 233 billion dollars.

The data is based on ad spending from domestic companies within the selected market, regardless of where an advertisement is displayed.

E-mail marketing, audio ads, influencer marketing or sponsorships, product placement, and commission-based affiliate systems are not considered here.

In 2023, Peru is expected to be the fastest-growing digital advertising market in the world, with an annual growth rate of about 20 percent. Argentina and Chile rounded out the top three yearly increases of approximately 19 and 17 percent, respectively. United States is the 9th fasted growing digital advertising market worldwide with annual increases of roughly 12%.

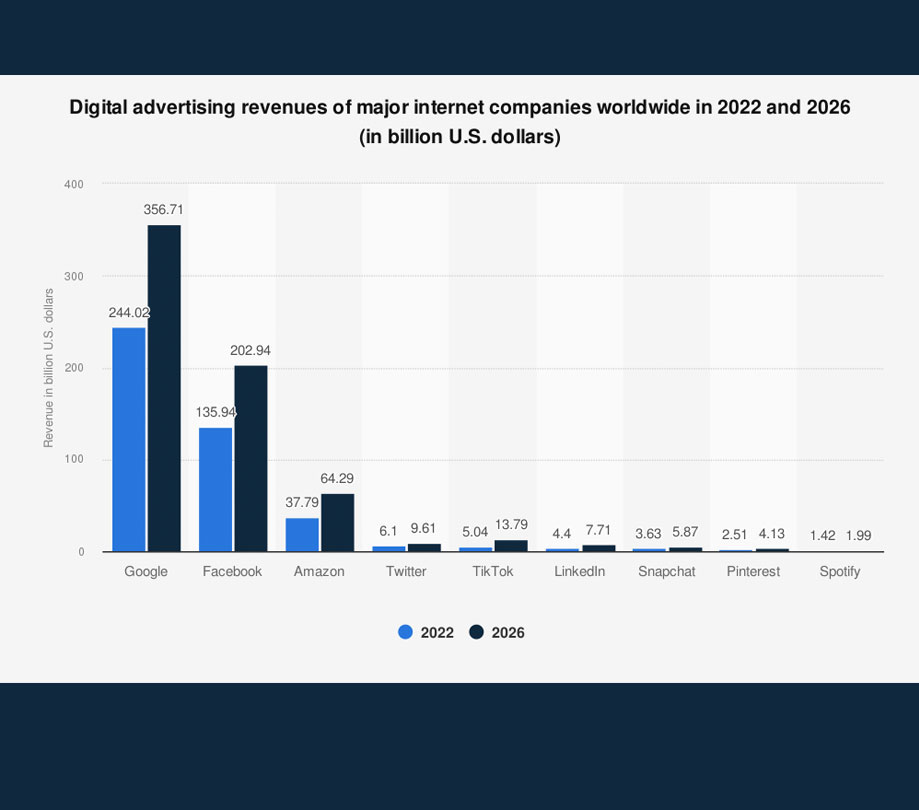

Digital advertising revenues of major internet companies worldwide in 2022 and 2026 (in billion U.S. dollars)

In 2022, Facebook's digital advertising revenues saw the Meta company generating 136 and were projected to reach 202.94 billion U.S. dollars by the end of the fiscal year 2026. TikTok was projected to see its online advertising revenues hit 13.79 billion U.S. dollars in 2026. By comparison, Google's advertising revenues are forecasted to reach approximately 356.71 billion in 2026. The growth rate is 46.18% from 2022.

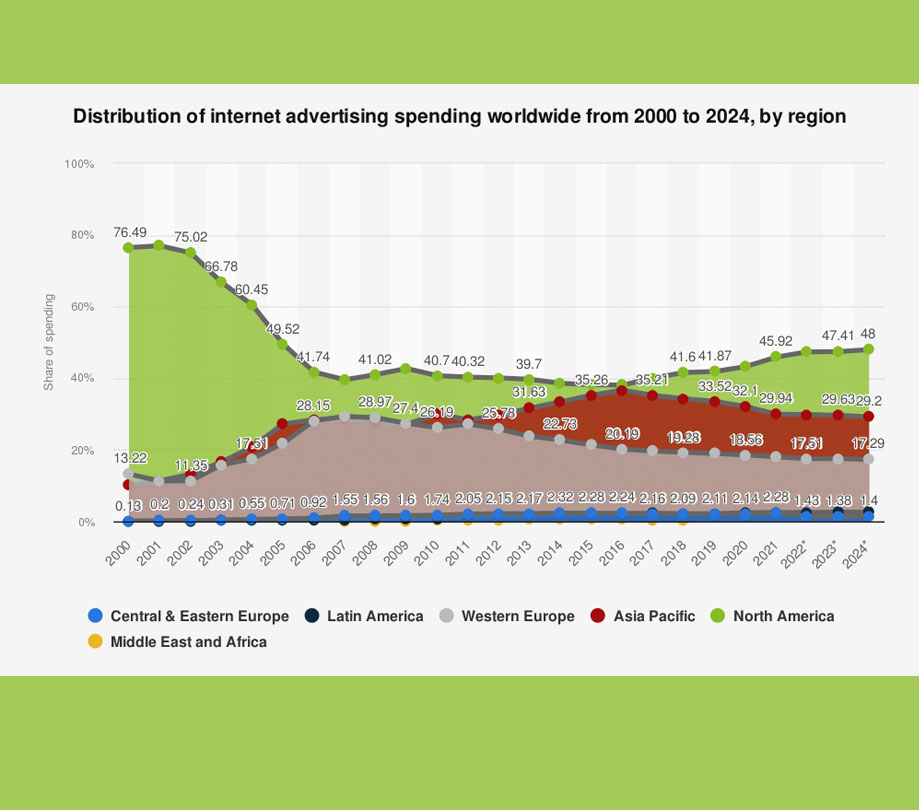

Distribution of internet advertising spending worldwide from 2000 to 2024 by region

Latin American expenditure is forecast to account for 2.48 percent of global internet advertising spending in 2022. Moreover, internet ad spending in North America is expected to contribute 47.37 percent in the same year.

Spending on internet advertising in North America amounted to nearly 192 billion U.S. dollars in 2021. According to forecast data, online ad expenditures in the region will suffer less than other media in light of the coronavirus outbreak in 2020 and will rebound by 2024 to reach 269 billion dollars.

In 2022, search advertising was the most invested-in digital advertising format in North America, attracting 94.38 billion U.S. dollars in Canada, Mexico, and the United States.

Search advertising ad spending worldwide 2017 - 2027

The data shown use current exchange rates and reflect the market impacts of the Russia-Ukraine war. Search advertising is expected to increase by 39.6% in 2027 from 2023.

The development of the internet infrastructure and the decreasing prices of internet-enabled devices such as PCs and smartphones are the main causes of the growth in search advertising.

The Internet infrastructure has seen tremendous transformation in the past ten years and is now quicker and cheaper. In addition, because internet-enabled devices have become more affordable, allowing more people to purchase and use them daily, search advertising is expected to grow significantly.

Before the COVID-19 pandemic, search advertising showed signs of steady and consistent development. However, the pandemic has accelerated digital adoption, resulting in exponential growth in search advertising, especially on marketplace platforms.

Even though data privacy regulations have been tightened globally and search engine platforms have taken steps to emphasize the importance of privacy, these platforms have already found a way to collect data more ethically and consent-based manner. In the coming years, we anticipate steady growth in search advertising across search engine and marketplace platforms.

The global banner advertising spending stood at roughly 67 billion U.S. dollars in 2022. According to the study, it's forecasted that the figure will increase annually at a growth rate of approximately 4.6 percent until 2028 when it is expected to exceed 87 billion.

The survey was conducted among 43 global brands, depending on the format. Ten percent of responding international brands stated they plan to increase their retail media budgets in 2023 significantly. Another 36 percent said they were planning to raise them slightly. The 43 global brands surveyed had a collective annual advertising spending of 44 billion U.S. dollars.

There are currently six major search engines, four of which are international: Google, Bing, Yahoo!, and DuckDuckGo. Yandex focuses on nations that speak Russian, while Baidu focuses on countries that speak Chinese. Due to its massive user base and effective internal advertising network, Google is by far the most popular among advertisers, with a 58% share.

Forty percent of responding industry professionals, marketers, and publishers from Australia, Colombia, India, Mexico, Singapore, the United Kingdom, and the United States stated that they were planning to adopt a marketing automation platform in the following six to 12 months, whereas 20 percent said they were planning to retire that technology.

The survey was conducted Apr 28, 2023, with 31,040 respondents online, 16 years and older; consumers who shop online at least once a month; Online interviews. In 2023, marketplaces will be the primary source of inspiration for online shopping globally. According to a survey, approximately 34 percent of online shoppers sought inspiration through searches on this channel. Search engines ranked second, with one-third of respondents using them.

When asked about brands and how they use consumer data to create personalized shopping experiences in 2023, approximately six in ten consumers worldwide said they typically only shared their personal information with a brand if it was required to proceed; nearly the same respondents said they are becoming increasingly concerned with how brands use their data. Overall, many people would rather avoid sharing their information for personalization.

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here