Tom Brady NFT sale sparks warning to consumers from experts

Wednesday, February 28, 2024

|

Freeman Lightner |

The Tom Brady NFT recently sold for 30.4k, and experts from the Smart Betting Guide have issued a warning to consumers buying NFTS, after their findings revealed NFT marketplaces and collections lost $38,114,817 to crypto scammers over the last year.

An expert has warned those considering purchasing an NFT off the back of the Tom Brady $40.7k sale, as NFT marketplaces saw $38 million stolen by scammers last year.

The findings, pulled together by Smart Betting Guide, analyzed a database recording crypto scams and exploits to identify the most vulnerable platforms and blockchains over the last year - with NFT marketplaces and collections frequently targeted by cybercriminals.

While NFTs benefit from decentralized ownership, verifiable authenticity, and transparent ownership history due to being built on blockchain technology, they are susceptible to security risks like phishing attacks, physical theft, malware, and social engineering attacks.

Expert issues warning after Tom Brady NFT sells for 30.4k, as marketplaces saw 30 million stolen last year

Before the Super Bowl LVIII, a video NFT of Tom Brady sold for $40,712, while an NFT of Joe Montana - who previously played for both the Chiefs and 49ers - went for $34,000.

The celebrity appeal behind these NFTs could see a surge in demand for more crypto endorsements, especially ahead of major sporting or starstudded events.

However, users should be cautious if considering making a purchase, as NFT platforms saw $38,114,817 in funds lost due to scams - the vast majority of which (97%) were stolen from Ethereum users ($37,065,295), followed by Binance ($1,024,522) and Cardano ($25,000).

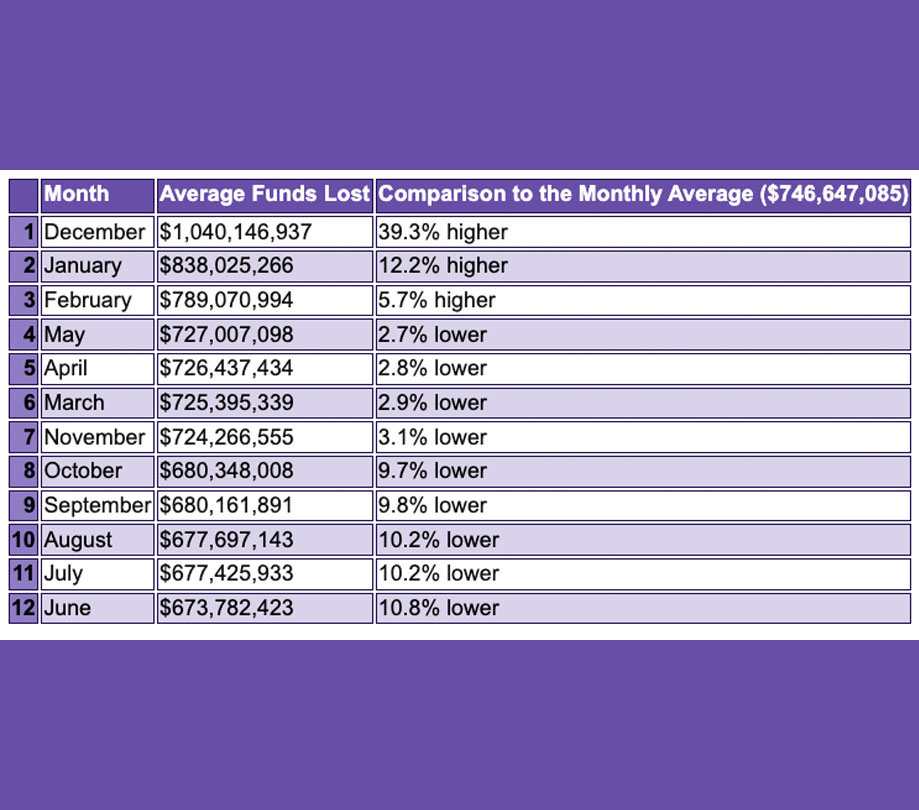

There’s all the more reason to be especially cautious now, as the analysis also found that February is one of the worst months for crypto losses, with an average of $789,070,994 taken by scammers each year. This is 6% above the typical monthly loss ($746,647,085).

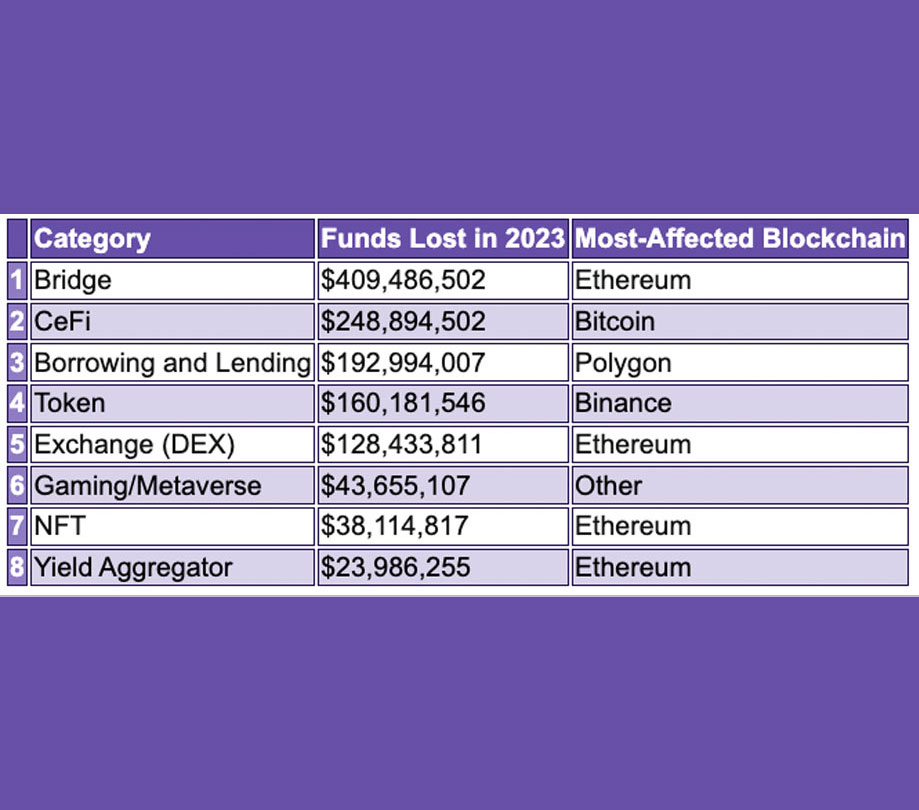

However, NFT databases and collections saw fewer funds stolen than other platforms, with crypto bridges losing more than $409 million ($409,486,502) due to exploits last year. This is 118% higher than the average loss reported across the affected platforms ($187,822,447).

The blockchain that saw the most funds stolen this way was Ethereum, accounting for 88% of the losses ($399,179,890), followed by Avas ($10,201,612) and Binance ($105,000).

Following behind as the second-most affected category is CeFi platforms, with $248,894,668 lost due to cybercriminals over the last year. This loss is a third (33%) above the average.

The platforms that saw the most funds lost last year due to scams

The category that saw the lowest sum lost was stablecoins, designed to maintain a stable value relative to a specific asset, such as other cryptocurrencies or commodities. In 2023, scammers stole $10,053,554 from this crypto - 95% below the average ($187.8k).

While February was the third month that saw the most funds stolen, the worst month came out as December, with a loss of $1,040,146,937 (39% above the monthly average).

Ranking second is January, with an average of $838,025,266 taken yearly. This is 12.2% above the monthly average and makes for a tough start to the year for blockchain users.

The risk drops slightly once we get into March, with the average sum lost equating to 2.9% less than the monthly average. Overall, the likelihood of being hit by a crypto scam is higher in the first half of the year compared to the second half - aside from in December.

Months ranked from highest to lowest likelihood of being targeted by scammers

As well as identifying when blockchain users are most likely to be targeted by scammers, the data reveals which scams resulted in the highest losses since 2011. Rug pull exit scams proved the most damaging, with a total of $51.9 billion stolen over the past 13 years.

Regarding the findings, Zigmas Pekarskas, CEO of Smart Betting Guide, said:

"As with any technical asset, cryptocurrency is vulnerable to scams - especially as it continues to grow in popularity and application. This is particularly true given crypto transactions are often anonymous and typically irreversible, so it’s difficult to trace transactions back to individuals.

Some platforms, including NFT databases, are more susceptible to cybercrime than others. When transacting on one of these platforms, ensure you do your research and due diligence. Research the NFT marketplace and the seller, focusing on reviews, ratings, and feedback from other users. This must be done even when purchasing an extremely limited or in-demand item, like the Tom Brady NFT that sold before the Super Bowl.

Verify that the NFT you’re interested in is authentic and not an authorized copy, and check the usage rights. Use a secure cryptocurrency wallet to store your funds and NFT assets - ideally with multi-signature support - and report any suspicious activity or fraudulent listings to the marketplace’s support team as early as possible."

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here

_r2f0ox12.jpg&width=800)