Insights on push alert frequency to improve new app user retention

Monday, March 27, 2017

|

Richard Harris |

New users aren't receiving push notifications says mobile industry findings by Urban Airship.

Mobile growth company Urban Airship detailed industry findings from its mobile app retention study, spanning new users’ first 90-days of app usage within retail, media, sports & recreation and utility/productivity. By analyzing the frequency of messaging users received and their corresponding retention rates, Urban Airship provides a deeper understanding that dispels common push notification myths and misconceptions and offers practical guidance to app publishers seeking to improve new user retention.

A long-held belief, especially for iOS apps where opting in to notifications requires explicit permission, is that opt-in users are simply more inclined to be retained longer. Data based on averages certainly backs this up. Retail apps see opt-in users retained 40 percent longer than opt-out audiences on iOS and 90 percent longer on Android - some of the biggest gains for any vertical.

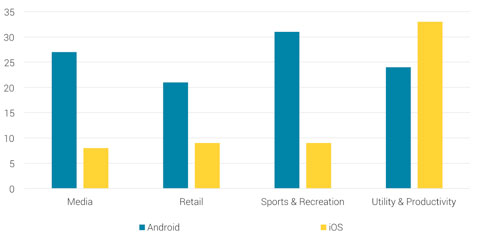

However, users who have made the effort to opt in and receive no messages have lower 90-day retention rates than opt-out audiences across both platforms and all verticals - the one exception is iOS Utility & Productivity where opt-outs retain one percentage point lower. For most verticals this difference is significant, like in Retail where opt-out users’ 90-day retention rates are 50 percent higher on Android and 36 percent higher on iOS than opt-in users who receive no messages. Further, these zero-send users represent a large share of every vertical’s opt-in audience.

Retail took the top spot for the lowest share of zero-send users at 18 percent of all opt-in users, followed by Media at 22 percent, Sports & Recreation at 24 percent and Utility & Productivity at 25 percent. For Android apps, zero-send users are the single biggest cohort in every vertical analyzed.

Taking into consideration average retention rates of opt-out and zero-send audiences, app users

who receive any amount of notifications in their first 90-days have an average retention rate that’s nearly 3X higher (190 percent). Within the four verticals, this retention gain is highest for retail at 212 percent more on Android and 110 percent more on iOS.

The general trend shows a very strong correlation between greater notification frequency and greater mobile app retention rates. Across all verticals and mobile platforms, users who received messaging at daily+ frequency also had the highest 90-day retention levels. While it’s true the longer and more frequently someone uses an app the more notifications they are likely to receive, the data accounts for users that may have opted out of notifications or deleted apps at different frequency levels, and more importantly, the last time they opened the app. The trend of greater retention with greater messaging frequency is unmistakable.

For retail, moving from zero notifications sent to weekly notifications is a 5X multiplier on 90-day retention rates for Android, and 2.5X greater on iOS retail. Retailers moving from zero notifications to a greater than daily frequency improve 90-day retention rates 3.5X on iOS and 6X on Android.

For retail apps, both Android and iOS show two strong groupings for 90-day retention levels that point to the need to move to weekly, daily and daily+ messaging. In contrast, media apps don’t see significant retention gains until moving to daily or greater frequency. Media app users who received one notification in 90-days had higher retention rates than weekly and 2X/month frequency cohorts, suggesting that while a welcome message is appreciated, media users expect as-it-happens information and sporadic or even weekly messaging doesn’t meet this need.

The zero-send issue, where apps ignore new users raising their hands for communication and as a result see the lowest retention rates nearly without exception, is a clear sign that apps are more focused on user acquisition than user engagement and retention. As it stands now, overall results show marketers lose 95 percent of new users within 90 days when they fail to message those who have opted in. Considering the high cost of mobile app user acquisition, as well as the loss of future potential customer value, this “APPathy” becomes expensive and unsustainable very quickly.

Even at a daily+ messaging frequency, retail apps see 50 percent of new iOS users churn 90-days after first app open, while for Android it’s 62 percent of new users. Marketers now have a solution to help identify users that are at risk of churning with Urban Airship’s Predictive Churn Analytics. Based on a proprietary machine-learning model, Predictive Churn Analytics analyses user patterns for each app and classifies users into three risk profiles - Low, Medium and High - making it easy to take action in Urban Airship or any other business system.

“Our data study findings clearly show that many apps are missing out on the single biggest opportunity to improve user retention by not messaging users that have opted in, which is incredibly easy to address,” said Erin Hintz, CMO, Urban Airship. “Once the basics are tackled, apps can zero in on customer-centric engagement strategies that produce optimal messaging frequencies for their industry to multiply retention rates. In addition, new machine-learning predictive capabilities can identify users at risk of churning while there’s still time to drive pre-emptive action.”

Visit Urban Airship’s Shoptalk booth #1225 for demonstrations of new solutions, including an Urban Airship Reach integration with Apple Pay for automatic rewards enrollment at checkout and ongoing customer engagement.

Urban Airship analyzed customer data in aggregate to identify apps with at least 5,000 downloads that had sent at least 1,000 cumulative push notifications in one month. Analysis focused on 63 million app users that first opened an app in September 2016, tracking their notification opt-in status, app open behaviour and volume of notifications received through December 2016.

Read more: https://www.urbanairship.com/

Opt-in audiences don’t have greater affinity for apps. They have greater expectations.

A long-held belief, especially for iOS apps where opting in to notifications requires explicit permission, is that opt-in users are simply more inclined to be retained longer. Data based on averages certainly backs this up. Retail apps see opt-in users retained 40 percent longer than opt-out audiences on iOS and 90 percent longer on Android - some of the biggest gains for any vertical.

However, users who have made the effort to opt in and receive no messages have lower 90-day retention rates than opt-out audiences across both platforms and all verticals - the one exception is iOS Utility & Productivity where opt-outs retain one percentage point lower. For most verticals this difference is significant, like in Retail where opt-out users’ 90-day retention rates are 50 percent higher on Android and 36 percent higher on iOS than opt-in users who receive no messages. Further, these zero-send users represent a large share of every vertical’s opt-in audience.

Percent of Opt-in Users Receiving Zero Push Notifications

More than one-quarter of the 47 million new app users who were opted

in to receive push notifications, received none in their first 90-days of

app usage and had lower retention rates than opt-out users.

in to receive push notifications, received none in their first 90-days of

app usage and had lower retention rates than opt-out users.

Taking into consideration average retention rates of opt-out and zero-send audiences, app users

who receive any amount of notifications in their first 90-days have an average retention rate that’s nearly 3X higher (190 percent). Within the four verticals, this retention gain is highest for retail at 212 percent more on Android and 110 percent more on iOS.

Concerns about sending too many notifications are unfounded

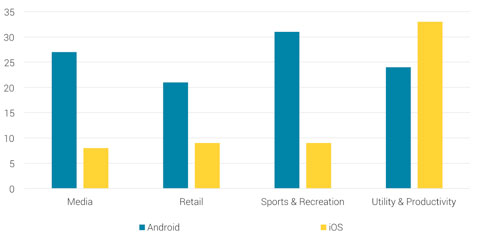

The general trend shows a very strong correlation between greater notification frequency and greater mobile app retention rates. Across all verticals and mobile platforms, users who received messaging at daily+ frequency also had the highest 90-day retention levels. While it’s true the longer and more frequently someone uses an app the more notifications they are likely to receive, the data accounts for users that may have opted out of notifications or deleted apps at different frequency levels, and more importantly, the last time they opened the app. The trend of greater retention with greater messaging frequency is unmistakable.

For retail, moving from zero notifications sent to weekly notifications is a 5X multiplier on 90-day retention rates for Android, and 2.5X greater on iOS retail. Retailers moving from zero notifications to a greater than daily frequency improve 90-day retention rates 3.5X on iOS and 6X on Android.

The frequency of push notifications received by a new retail app user strongly

correlates to higher 90-day mobile app retention rates.

correlates to higher 90-day mobile app retention rates.

For retail apps, both Android and iOS show two strong groupings for 90-day retention levels that point to the need to move to weekly, daily and daily+ messaging. In contrast, media apps don’t see significant retention gains until moving to daily or greater frequency. Media app users who received one notification in 90-days had higher retention rates than weekly and 2X/month frequency cohorts, suggesting that while a welcome message is appreciated, media users expect as-it-happens information and sporadic or even weekly messaging doesn’t meet this need.

The balance of app publishers’ attention must shift from user acquisition to retention

The zero-send issue, where apps ignore new users raising their hands for communication and as a result see the lowest retention rates nearly without exception, is a clear sign that apps are more focused on user acquisition than user engagement and retention. As it stands now, overall results show marketers lose 95 percent of new users within 90 days when they fail to message those who have opted in. Considering the high cost of mobile app user acquisition, as well as the loss of future potential customer value, this “APPathy” becomes expensive and unsustainable very quickly.

Even at a daily+ messaging frequency, retail apps see 50 percent of new iOS users churn 90-days after first app open, while for Android it’s 62 percent of new users. Marketers now have a solution to help identify users that are at risk of churning with Urban Airship’s Predictive Churn Analytics. Based on a proprietary machine-learning model, Predictive Churn Analytics analyses user patterns for each app and classifies users into three risk profiles - Low, Medium and High - making it easy to take action in Urban Airship or any other business system.

“Our data study findings clearly show that many apps are missing out on the single biggest opportunity to improve user retention by not messaging users that have opted in, which is incredibly easy to address,” said Erin Hintz, CMO, Urban Airship. “Once the basics are tackled, apps can zero in on customer-centric engagement strategies that produce optimal messaging frequencies for their industry to multiply retention rates. In addition, new machine-learning predictive capabilities can identify users at risk of churning while there’s still time to drive pre-emptive action.”

Visit Urban Airship’s Shoptalk booth #1225 for demonstrations of new solutions, including an Urban Airship Reach integration with Apple Pay for automatic rewards enrollment at checkout and ongoing customer engagement.

Methodology

Urban Airship analyzed customer data in aggregate to identify apps with at least 5,000 downloads that had sent at least 1,000 cumulative push notifications in one month. Analysis focused on 63 million app users that first opened an app in September 2016, tracking their notification opt-in status, app open behaviour and volume of notifications received through December 2016.

Read more: https://www.urbanairship.com/

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here