The best and worst of banking apps in 2017

Tuesday, December 12, 2017

|

Austin Harris |

Mobile banking app report gives us the best and worst apps on the market for your quick-and-easy financial needs.

It’s difficult to remember how frustrating mobile banking was for users just five years ago. Some mobile banking apps would struggle to find the nearest ATM. Depositing checks by capturing an image was considered cutting edge. It was even quite possible your bank didn’t have a smartphone app.

Fast forward to today. Now, alerts from banking apps is a feature that we take for granted. Most apps, if the bank offers a credit card account, will show you your current credit score. Some banks are even allowing you to make ATM withdrawals through the app, without a bank card.

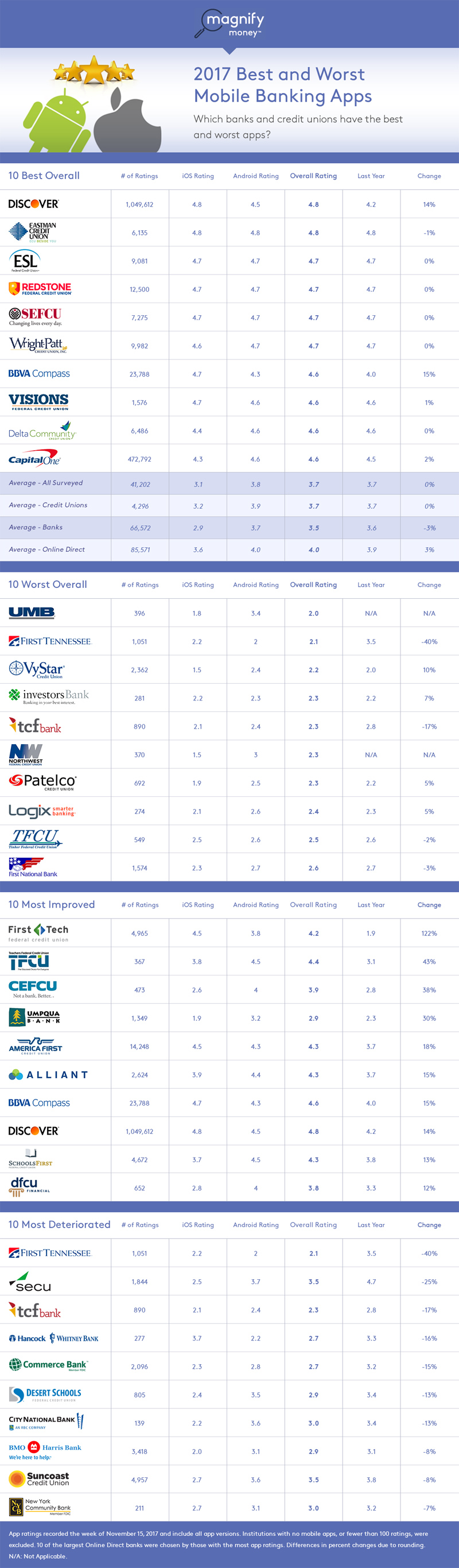

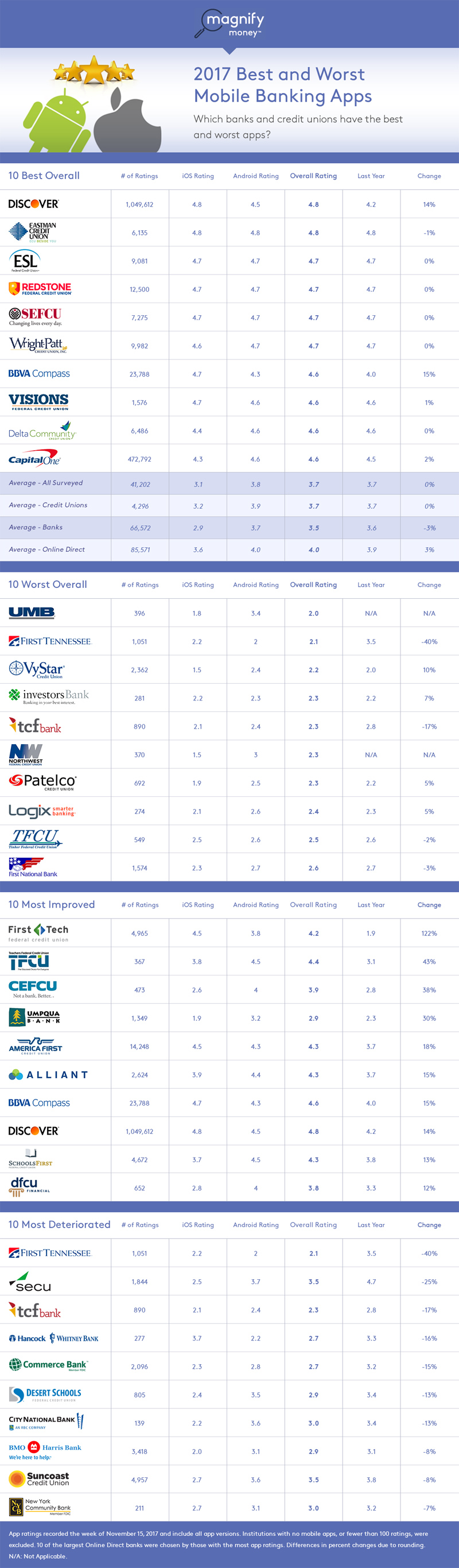

The data in MagnifyMoney’s 2017 mobile banking ratings indicates that, as a class, banking apps have matured. Overall, apps haven’t appreciably improved, with users on the Apple App Store and Google Play rating banking apps an average of 3.7 stars (out of 5), as they did in 2016. But this year, none of the mobile banking apps can be considered especially awful anymore.

Discover has managed to keep the more than 1 million people who have used its mobile app relatively content. Part of its success may lie in serving more credit card-only users than mobile apps from other large banks, which tend to have customers primarily using mobile apps for more traditional checking and savings accounts. Nonetheless, its score of 4.8 is the highest of any institution in our rankings this year.

Apart from laggard BB&T, the apps of the 10 largest banks were rated better than average by users, which is quite a feat when you consider that many of these apps, like Wells Fargo Mobile and Citi Mobile, not only offer savings, checking and credit card accounts, but also more complicated products like brokerage accounts and holistic personal finance management programs similar to websites like Mint.com.

Among the 10 online direct apps we found more dispersion in app user satisfaction. While Discover tops the list with a weighted overall rating of 4.8, four of the banks had apps with a rating of less than 4. Still, nearly all the apps in this category saw a modest improvement in user satisfaction versus last year.

Credit union customers (shareholders, in Credit Union’s language) tend to be happier than those who use traditional banks, and that trend continues for mobile apps.

5 of the 10 largest credit unions have the same overall score of 4.3, which is unsurprising as the interface of many credit union apps are from the same software developer.

App ratings were recorded the week of Nov. 15, 2017 in the Google Play and Apple App Stores, and include ratings for all app versions. Overall ratings are a weighted average, rounded to the nearest tenth, of iOS and Android ratings based on the number of reviews for each platform. Institutions with no mobile apps were excluded from ranking summaries.

The 50 largest banks, defined as those with the largest deposits per FDIC data June 2017, were examined. Those not offering consumer checking accounts were excluded. The 50 largest credit unions by assets according to the CUNA in September 2017 were examined. For online direct banks, and 10 of the largest online direct banks were chosen by number of app ratings.

Read more: http://www.magnifymoney.com/blog/reviews/mobile-ba...

Fast forward to today. Now, alerts from banking apps is a feature that we take for granted. Most apps, if the bank offers a credit card account, will show you your current credit score. Some banks are even allowing you to make ATM withdrawals through the app, without a bank card.

The data in MagnifyMoney’s 2017 mobile banking ratings indicates that, as a class, banking apps have matured. Overall, apps haven’t appreciably improved, with users on the Apple App Store and Google Play rating banking apps an average of 3.7 stars (out of 5), as they did in 2016. But this year, none of the mobile banking apps can be considered especially awful anymore.

MagnifyMoney’s 2017 Mobile Banking findings:

- Best Overall App: Discover with a score of 4.8, up from 4.2 in 2016.

- Best Apps Among the 10 Largest Banks: Chase and Capital One both scored 4.6.

- Worst App Among the 10 Largest Banks: BB&T with a score of 3.0, improving from 2.8 in 2016.

- Best Apps Among the 10 Largest Credit Unions: SchoolsFirst, PenFed, Alliant, BECU and America First all scored 4.3, well above the average of 3.7 for all credit union apps.

- Worst App Among the 10 Largest Credit Unions: Star One with a score of 3.2, down from 3.3 in 2016.

- Best Online Direct Bank App: Discover Bank with a score of 4.8, up from 4.2 in 2016.

- Worst Online Direct Bank App: Ally Bank, with a score of 3.4, improving from 3.1 in 2016.

- Overall Most Improved App: First Tech Federal Credit Union, with a score increase of 122% year over year, from 1.9 to 4.2.

- Most Improved Traditional Bank: Umpqua Bank, with a 30% ratings increase year over year, from 2.3 to 2.9.

- Overall Most Deteriorated App: First Tennessee, whose score dropped 40%, from 3.5 to 2.1 year over year.

Discover tops them all

Discover has managed to keep the more than 1 million people who have used its mobile app relatively content. Part of its success may lie in serving more credit card-only users than mobile apps from other large banks, which tend to have customers primarily using mobile apps for more traditional checking and savings accounts. Nonetheless, its score of 4.8 is the highest of any institution in our rankings this year.

Bigger is getting better

Apart from laggard BB&T, the apps of the 10 largest banks were rated better than average by users, which is quite a feat when you consider that many of these apps, like Wells Fargo Mobile and Citi Mobile, not only offer savings, checking and credit card accounts, but also more complicated products like brokerage accounts and holistic personal finance management programs similar to websites like Mint.com.

Online banking still a mixed bag

Among the 10 online direct apps we found more dispersion in app user satisfaction. While Discover tops the list with a weighted overall rating of 4.8, four of the banks had apps with a rating of less than 4. Still, nearly all the apps in this category saw a modest improvement in user satisfaction versus last year.

Credit unions hold steady

Credit union customers (shareholders, in Credit Union’s language) tend to be happier than those who use traditional banks, and that trend continues for mobile apps.

5 of the 10 largest credit unions have the same overall score of 4.3, which is unsurprising as the interface of many credit union apps are from the same software developer.

Methodology

App ratings were recorded the week of Nov. 15, 2017 in the Google Play and Apple App Stores, and include ratings for all app versions. Overall ratings are a weighted average, rounded to the nearest tenth, of iOS and Android ratings based on the number of reviews for each platform. Institutions with no mobile apps were excluded from ranking summaries.

The 50 largest banks, defined as those with the largest deposits per FDIC data June 2017, were examined. Those not offering consumer checking accounts were excluded. The 50 largest credit unions by assets according to the CUNA in September 2017 were examined. For online direct banks, and 10 of the largest online direct banks were chosen by number of app ratings.

Read more: http://www.magnifymoney.com/blog/reviews/mobile-ba...

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here