API

Personal Financial Wellness API announced at Digital Banking Summit

Wednesday, June 14, 2017

|

Richard Harris |

Financial predictive analytics and financial data insight API, Personal Financial Wellness, released at Digital Banking Summit.

Life and technology are becoming inseparable, with services like Amazon Alexa providing on-demand insights and forward-looking advice through the data we willingly provide to them. When it comes to leveraging that data to guide consumers in achieving financial balance and wellness, however, this type of simple, digital personalized guidance is lacking. This is surprising given that financial stress is the number one culprit for stress for 7 out of 10 American workers and almost half of us have trouble paying a $400 emergency expense.

Envestnet | Yodlee, a data aggregation and analytics platform for digital financial services, has announced the launch of its Personal Financial Wellness Solution at the Digital Banking Summit. The Envestnet | Yodlee Personal Financial Wellness Solution is a suite of applications and APIs that leverages enriched data and artificial intelligence to move beyond organizing historical financial data.

As financial institutions look for ways to sustain valuable customer relationships, they should look beyond historical transaction data to provide valuable forward-looking insights & advice. The solution enables financial institutions and fintech developers to provide actionable tools to help consumers, like OK to Spend. By applying their data intelligence to its transaction data of over 15,000 data sources, financial service providers can derive actionable information from consumers’ financial data in order to measure, guide and improve consumers’ financial health.

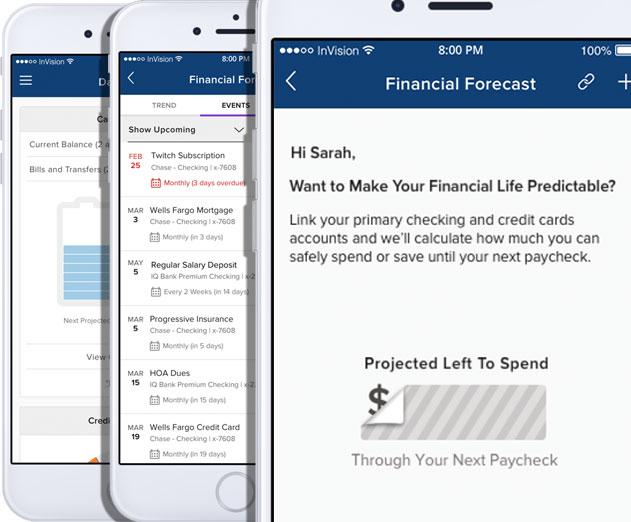

One of the features at the core of the Personal Financial Wellness Solution is OK to Spend, which synergizes predictive analytics and user feedback to deliver financial forecasting. OK to Spend can be consumed as a financial application or a fully RESTful API framework that enables financial service providers to create forward-looking forecasts that organize and predict recurring income and financial obligations along with personalized notifications for financial events and projected balances. OK to Spend analytics is run across the consumers’ primary spending accounts (cash and credit card) regardless of which financial institution they primarily bank with, in order to provide a holistic view of their finances.

“Relationship-based banking has been the key to success and customer loyalty for financial institutions for years. As more consumers continue to use digital channels, they’re expecting banks to offer personalized user experiences that helps them reach their financial goals,” said Katy Gibson, Vice President of Product Applications at Envestnet | Yodlee. “By using the Envestnet | Yodlee Data Intelligence Platform, our goal is to empower financial service providers to create personalized and actionable insights and recommendations for consumers. Helping consumers meet their financial goals is the best way to build lasting customer relationships.”

Envestnet | Yodlee, a data aggregation and analytics platform for digital financial services, has announced the launch of its Personal Financial Wellness Solution at the Digital Banking Summit. The Envestnet | Yodlee Personal Financial Wellness Solution is a suite of applications and APIs that leverages enriched data and artificial intelligence to move beyond organizing historical financial data.

As financial institutions look for ways to sustain valuable customer relationships, they should look beyond historical transaction data to provide valuable forward-looking insights & advice. The solution enables financial institutions and fintech developers to provide actionable tools to help consumers, like OK to Spend. By applying their data intelligence to its transaction data of over 15,000 data sources, financial service providers can derive actionable information from consumers’ financial data in order to measure, guide and improve consumers’ financial health.

OK to Spend

One of the features at the core of the Personal Financial Wellness Solution is OK to Spend, which synergizes predictive analytics and user feedback to deliver financial forecasting. OK to Spend can be consumed as a financial application or a fully RESTful API framework that enables financial service providers to create forward-looking forecasts that organize and predict recurring income and financial obligations along with personalized notifications for financial events and projected balances. OK to Spend analytics is run across the consumers’ primary spending accounts (cash and credit card) regardless of which financial institution they primarily bank with, in order to provide a holistic view of their finances.

“Relationship-based banking has been the key to success and customer loyalty for financial institutions for years. As more consumers continue to use digital channels, they’re expecting banks to offer personalized user experiences that helps them reach their financial goals,” said Katy Gibson, Vice President of Product Applications at Envestnet | Yodlee. “By using the Envestnet | Yodlee Data Intelligence Platform, our goal is to empower financial service providers to create personalized and actionable insights and recommendations for consumers. Helping consumers meet their financial goals is the best way to build lasting customer relationships.”

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here