ADAS technology driving the automotive software market

Monday, September 26, 2022

|

Freeman Lightner |

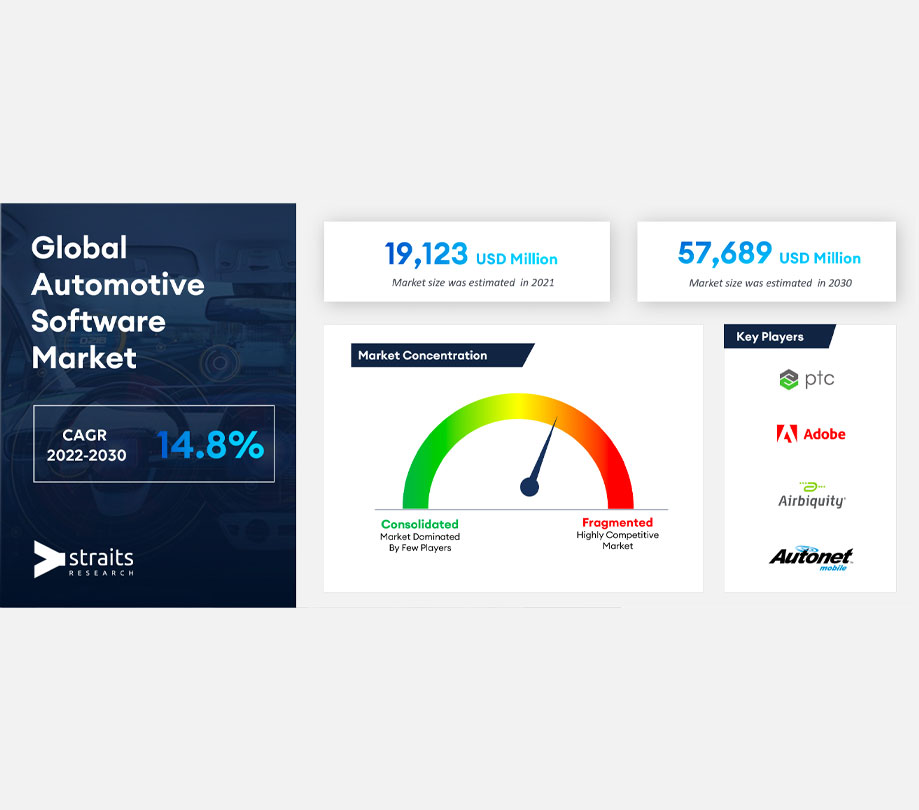

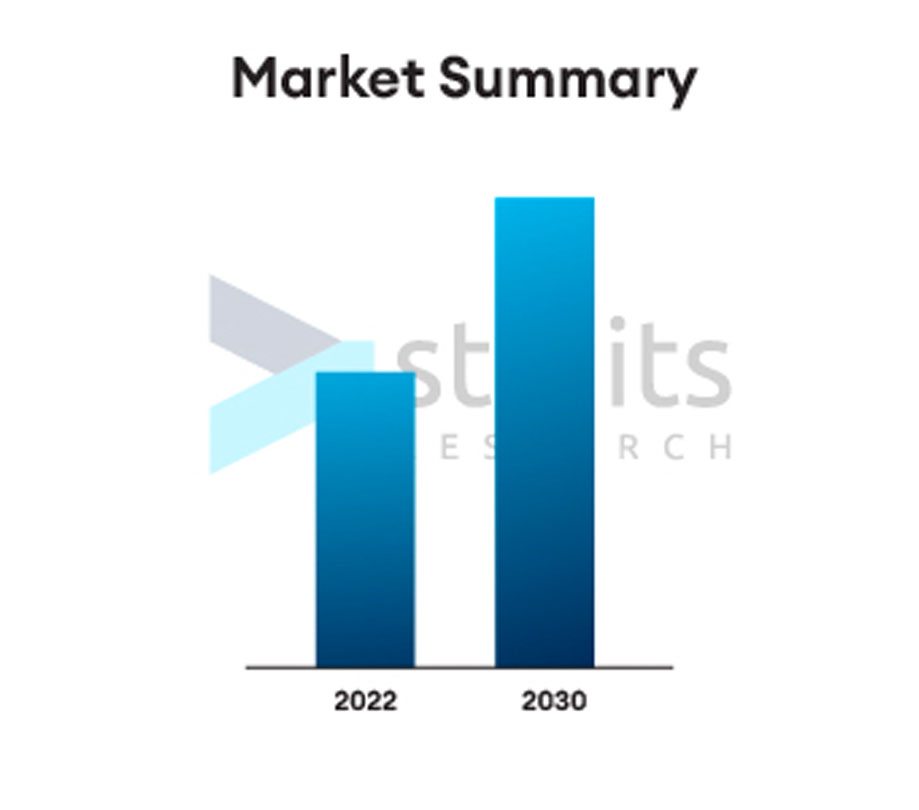

According to Straits Research, the global automotive software market was valued at $19.12B USD in 2021 and is projected to reach $57.68B by 2030 with the help of ADAS technology, AI, and 5G, growing at a CAGR of 14.8%. The Asia Pacific will command the market with the largest share.

Diverse industries strive to adapt as quickly as possible to the rapid transition to digital technology. Software and mobile applications have made things so straightforward and practical that business owners may maximize their use of them. Automotive software is a set of programmable data instructions for executing computer-based in-vehicle applications. Automotive software also includes software used for embedded vehicle systems. Computer applications within a car include telematics, entertainment, powertrain, body control and comfort, communication, advanced driver assistance systems (ADAS), and safety. Automobiles will speak with one another and with drivers soon. With so many vehicles requiring maintenance or repair, it is difficult for the staff to perform jobs and maintain organization. Because of this, every workshop, garage, and car shop should invest in automotive software. Automobile manufacturers have been compelled by these technological advancements to incorporate vehicle software solutions that give more excellent utility and convenience for customers.

Automotive software market size is projected to reach $57.68B USD by 2030, growing at a CAGR of 14.8%: Straits Research

The utilization of ADAS technologies in vehicles increases the utilization of connected car services. Introducing technical breakthroughs for enhanced UI will stimulate the market's growth for automotive software. Moreover, the absence of standard protocols and norms for software platform development, a lack of interconnected infrastructure, and the diagnosis and repair of automotive software restrict the evolution of the automotive software market. Moreover, the potential of 5G and AI, the increasing development of semi-autonomous and autonomous vehicles, and the monetization of data in the extended automotive ecosystem are expected to generate excellent growth opportunities for the automotive software industry.

The implementation of ADAS features and connected car services to drive the global automotive software market

The automotive sector has made tremendous advancements in self-driving car technology in recent years, and advanced driver assistance systems (ADAS) are a fundamental component of this technology. In addition to the growing demand for advanced safety systems such as adaptive cruise control and autonomous emergency braking systems and the increased government regulations to reduce traffic accidents, the major automotive OEMs are incorporating ADAS features into the next generation of vehicles. With software-driven features such as lane monitoring, emergency braking, stability controls, and others, ADAS technologies have eased driving significantly. Due to the introduction of ADAS capabilities into the next generation of vehicles, a significant number of Tier 1 businesses and OEMs are developing collaborations with software development companies to create advanced ADAS software. As a result, the market for automobile software is growing.

In addition, the connection is now a regular feature of virtually all electronic devices, including automobiles. These services enable automobile manufacturers, fleet operators, and drivers to enhance resource usage, promote safety, automate key driving activities, and generate crucial data, such as vehicle performance and road conditions. Embedded, integrated, cloud and tethered connection options may provide connected car services in a vehicle. Numerous connected vehicle services demand software to perform their respective functions. Moreover, the surge in demand for connected car services is mainly related to an increase in safety and security concerns, a rise in the desire for a better driving experience, and the arrival of the internet of things (IoT) in the automotive industry. Consequently, the expansion of automotive software for connected services can be attributed to the increasing number of advanced services offered in connected automobiles.

5G and artificial intelligence future potential to create global automotive software market opportunities

AI and 5G will play a significant role in the future of the automotive industry as predictive capabilities grow more pervasive in vehicles and the driving experience becomes increasingly personalized. More automakers are automating the vehicle setting using data-driven algorithms, including the infotainment system and application preferences. Moreover, 5G is better equipped to carry out critical communications for safer driving, support greater vehicle-to-vehicle (V2V) connectivity, and enable connected mobility solutions. As a result, the large array of 5G and AI applications in future mobility is predicted to generate lucrative growth opportunities for the automotive software market soon.

Report scope

| Report Metric | Details |

| Market Size | USD 57.68 Billion by 2030 |

| CAGR | 14.8% (2022-2030) |

| Historical Data | 2019-2020 |

| Base Year | 2021 |

| Forecast Period | 2022-2030 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Application, Product, Vehicle Type, Region |

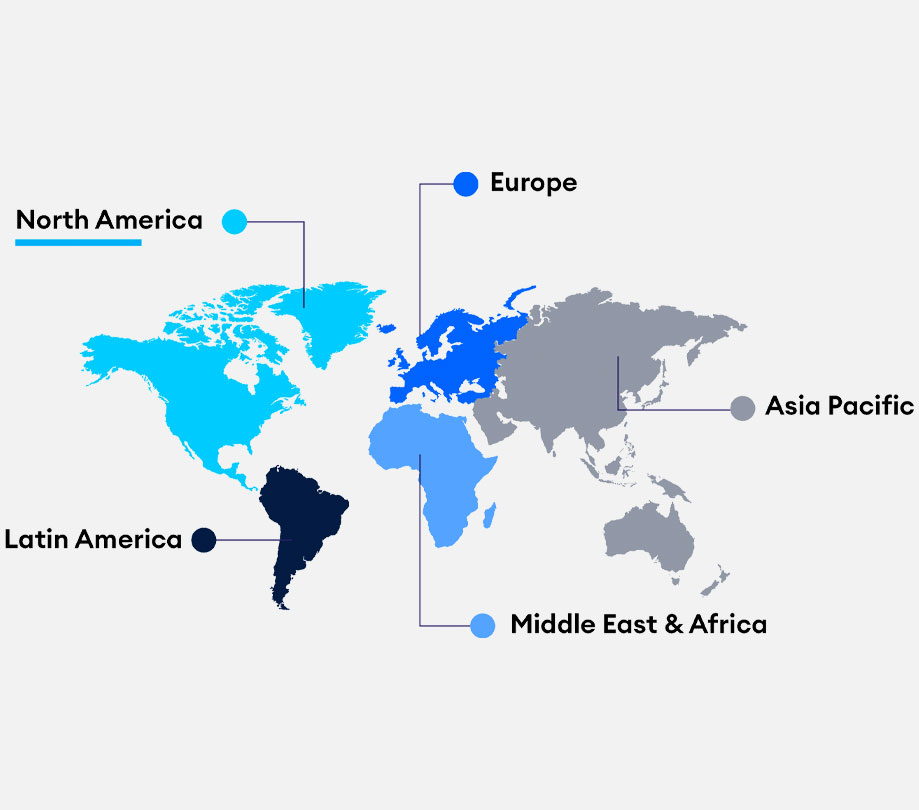

| Geographies Covered | North America, Europe, Asia-Pacific, LAME, and Rest of the World |

| Key Companies Profiled/Vendors | Adobe Inc., Airbiquity Inc., Atego Systems Inc. (PTC), Autonet Mobile, Inc., Blackberry Limited, Goggle, Green Hills Software, Microsoft Corporation, Montavista Software, Wind River Systems, Inc. |

| Key Market Opportunities | 5G and Artificial Intelligence Future Potential to Boost Market Opportunities |

| Key Market Drivers | The Implementation of ADAS Features and Connected Car Services to Aid Growth |

Regional insights

The Asia Pacific will command the market with the largest share while growing at a CAGR of 16.9%. Rapidly rising luxury automobile sales in emerging markets such as China, Thailand, and India are predicted to boost the growth of the Asia-Pacific automotive software market. This region's automotive software market is primarily driven by the rapid expansion of intelligent transportation systems and connected mobility in countries such as China and Japan. For instance, in 2019, the 5G Automotive Association (5GAA), SAIC Motor, China Mobile, Huawei, and Shanghai International Automobile City announced the 2020 launch of the first 5G-based smart transportation demonstration project. This endeavor will occur in Shanghai International Automobile City. The four companies are working on 5G internet communications, intelligent driving, intelligent mobility, supporting infrastructure, and piloting 5G-based services for smart driving and intelligent mobility.

Europe will hold a share of USD 20,612 million, growing at a CAGR of 15.4%. Increasing adoption of software-based technologies like ADAS, in-vehicle infotainment, and telematics is among the reasons driving the growth of the European automotive software market. Also contributing to this growth are the rising vehicle industry, technological advancements, and government regulations designed to enhance the diving experience. For instance, the SMMT or Society of Motor Manufacturers and Traders predicts that by 2025, more than 95% of all vehicles currently running on British roads will be connected. The following government rules dealing with driver safety & security issues require automakers to provide in-vehicle infotainment with hands-free linked calls, fueling the expansion of the European automotive software market.

Key highlights

- The global automotive software market size had a revenue share of USD 19,123 million in 2021, envisioned to reach USD 57,689 million growing at a CAGR of 14.8% during the forecast period.

- Based on application, the infotainment & telematics segment is projected to advance at a CAGR of 16.5% and hold the largest market share.

- Based on product, the application software segment is projected to grow at a CAGR of 14.3% and hold the largest market share.

- Based on vehicle type, the ICE passenger car segment is projected to advance at a CAGR of 11.1% and hold the largest market share.

- Based on regional analysis, the Asia Pacific will command the market with the largest share while growing at a CAGR of 16.9%.

Competitive players in the market

- Adobe Inc.

- Airbiquity Inc.

- Atego Systems Inc. (PTC)

- Autonet Mobile, Inc.

- Blackberry Limited

- Goggle

- Green Hills Software

- Microsoft Corporation

- Montavista Software

- Wind River Systems, Inc.

Global automotive software market: segmentation

By application

- Safety System

- Infotainment And Telematics

- Powertrain

- Chassis

By product

- Operating System

- Middleware

- Application Software

By vehicle type

- ICE Passenger Car

- ICE Light Commercial Vehicle

- ICE Heavy Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Autonomous Vehicles

By region

- North America

- Europe

- Asia-Pacific

- LAMEA

To view the full report please visit https://straitsresearch.com/report/automotive-software-market/

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here

_cptybzmh.jpg)