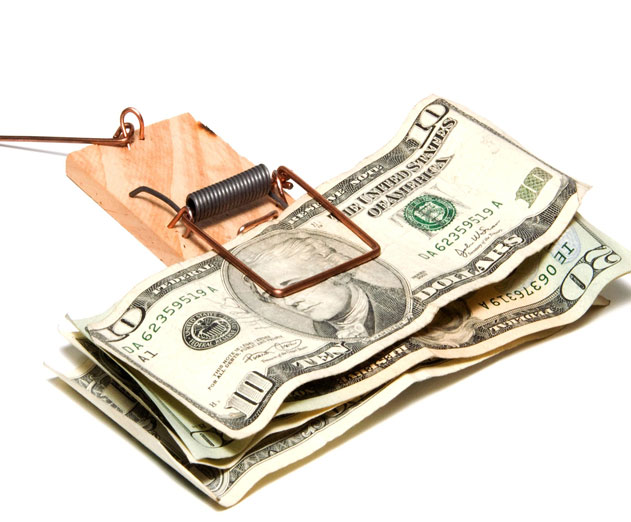

Breaking Out of The App User Acquisition Funding Trap With Pollen VC

Friday, December 19, 2014

|

Martin Macmillan |

I got my first taste of the app world when I co-founded an interactive music company (Soniqplay) that provided an app for users to remix and share music around the world. Since the inception, I led a team that successfully saw our idea come to fruition after 18 months of hard developing and planning.

The User Acquisition Funding Dilemma

After a lot of blood, sweat and tears we launched the app in the App Store on iOS. Initially we had a successful launch and quickly saw great traction, acquiring 40,000 users in our first month, however we were not receiving earned app store money back quickly enough to fuel our growth and acquire users to reach critical mass.

Like many bootstrapped app companies, the funding gap limited the amount of funds we were able to reserve for User Acquisition (UA) and promotion. Instead, we fell into the trap of not being able to generate enough early revenue to survive. It soon became clear that there was a gap in the market to provide additional liquidity into the app ecosystem to help developers. The idea for Pollen’s Velocity Capital was formed soon after.

The Approach to Creating Pollen VC

I began my career in the FinTech industry almost 20 years ago. Over that time I have faced my share of twists and turns, especially as it relates to startup life. Working with UBS as a bond trader leading short credit trading for the company, my first taste of how technology could disrupt traditional financial services came in 1998, when I helped UBS put its Commercial Paper business online.

Early on I learned the importance of staying steadfast as I faced multiple obstacles in implementing major change at a large organization. Through this experience, I gained a fond understanding of the banking industry, especially what investors look for when funding outside projects, the process it takes to gain that money, and how to construct a business that is appealing to investors around the world.

Following my tenure at UBS, I spent 9 years building a FinTech company in retail banking, before deciding to focus my attention on the music space which gave me my first taste of the app world,

After many conversations with “traditional” invoice discounters and other developers, it became clear that there was a need for Pollen VC’s funding for developers. I quickly learned there were many other app publishers facing the same issues that I had, and that many would benefit from being able to access app store revenues more quickly, particularly the aspect of enabling reinvestment into user acquisition.

Building a Better Funding Opportunity for App Publishers

I decided to turn the problem I faced at Soniqplay – lack of access to earned revenue – into a solution. When building Pollen, I partnered with a team at YUZA, an incubator and creator of platform-based mobile ventures. I aligned with co-founders who, like myself, understood both traditional financial services and the mobile app space.

Our first challenge was a massive one – resolve the disconnect between the parameters of how digital marketplaces operate and how traditional financial services providers operate. It was imperative that we were surrounded by top tier investors and advisors who understood both sides of these very different worlds.

Taking the idea a step further, we wanted to align Pollen VC with leading mobile advertising networks so that developers could reinvest their earned cash back into their business more easily. No longer would developers need to use borrowed cash or credit cards to continue the momentum of their app - they would now use their app store sales to directly fund their own user acquisition and growth.

Within 30 days of incorporating, we had closed our seed funding round with a range of top-tier investors. Pollen was so well received that we ended up increasing the size of our seed round as we were oversubscribed and didn’t want to disappoint investors who we knew could be really helpful in helping us build our business. We knew that the opportunity ahead of us was huge!

How Velocity Capital Works

We call this new funding opportunity “Velocity Capital.” Pollen VC gives app developers faster access to revenues they’ve already earned from the app stores. Revenue can be channeled back into user acquisition immediately, meaning that the app or game is funding its own user growth, and developers are less reliant on self-funding or venture capital to grow user numbers.

When developers sign-up for Pollen they are on-boarded in as little as 48 hours and offered two choices of how to use their earned app store revenues. They can either choose to receive 95% of their earned cash every seven days, or reinvest 100% of daily sales revenue back into an ad sales network the next day.

So far we have seen that around 70% of funds get recycled back into user acquisition. Pollen works with apps in many verticals. Naturally, gaming apps are the strongest, however, we have also worked with apps in the educational, healthcare, and financial verticals, among others.

One big differentiator that our clients have let us know they enjoy with Pollen VC is our ability to be elastic. Whether rolling out a gaming app quickly or a utility app that has a longer life usage – takes more time to develop and catch-on, but lasts longer – Pollen can move extremely fast or slow as needed to help apps achieve their UA goals.

What I Learned Along the Way

Most app developers try to immediately achieve the success of Yo! or Flappy Bird, but the truth is most will not, let alone come close during their early lifecycle. Considering your audience and catering to them will ultimately determine your success or failure.

Developers must think about the how adopters will use the app and what will keep them coming back on a consistent basis, and develop a product that clearly relates to that. You must differentiate yourself from the competition to create a unique brand identity and delight your customers. Use all of the resources available to achieve success, especially the money that you have already earned.

If you’d like to talk about how Velocity Capital can work to help your app publishing business, visit our website and use our contact link to reach out to our team in our San Francisco office or in our UK office.

Read more: https://pollen.vc/

This content is made possible by a guest author, or sponsor; it is not written by and does not necessarily reflect the views of App Developer Magazine's editorial staff.

Become a subscriber of App Developer Magazine for just $5.99 a month and take advantage of all these perks.

MEMBERS GET ACCESS TO

- - Exclusive content from leaders in the industry

- - Q&A articles from industry leaders

- - Tips and tricks from the most successful developers weekly

- - Monthly issues, including all 90+ back-issues since 2012

- - Event discounts and early-bird signups

- - Gain insight from top achievers in the app store

- - Learn what tools to use, what SDK's to use, and more

Subscribe here

_cptybzmh.jpg)